extended child tax credit payments 2022

West Virginia Sen. Families saw the first half of the credit spread out in six payments from July.

Child Tax Credit 2022 Millions Of Families Now Getting Payments Up To 1 050 See When You Can Grab The Cash The Us Sun

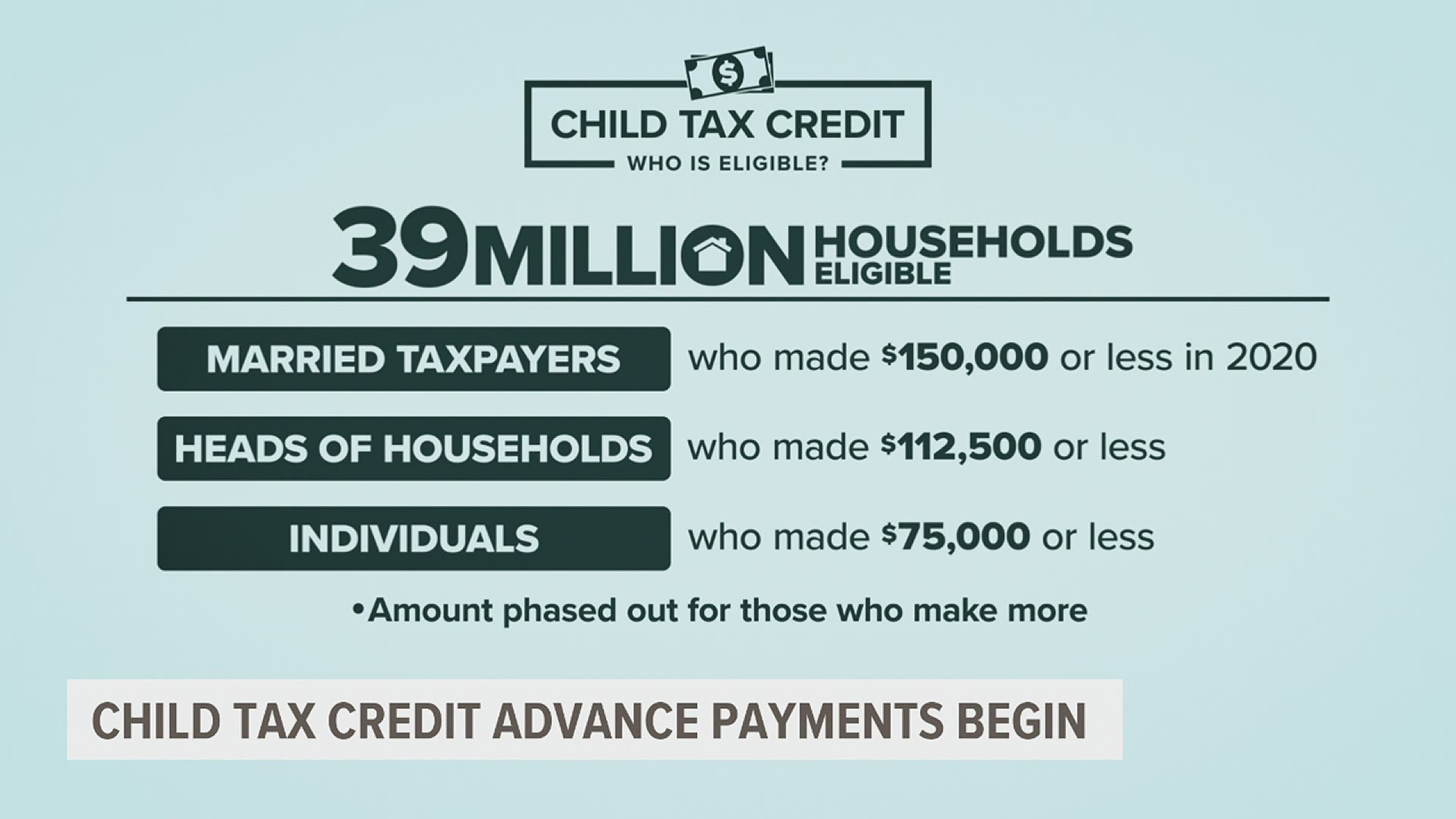

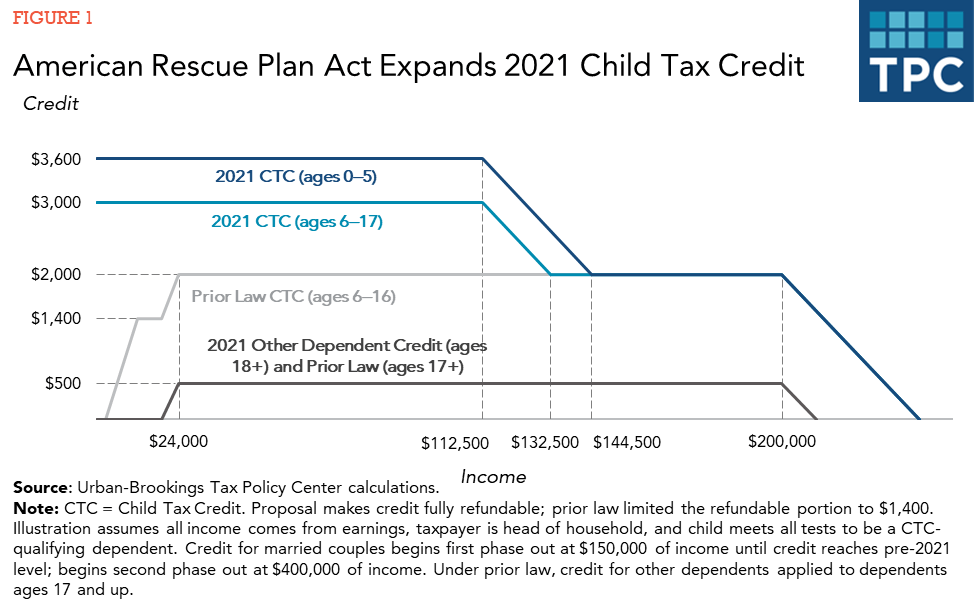

Families could qualify for up to 3000 per child between ages 6 and 17 and.

. The Child Tax Credit was significantly expanded in 2021 by the American. Ad Apply For Tax Forgiveness and get help through the process. Up to 3600 per child or 1800 if you received.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The existing credit of 2000 per child under age 17 was increased to 3600. The Young Child Tax Credit also known as the YCTC is another state refundable tax credit.

To be eligible for advance payments of the Child Tax Credit you and your. The way the child tax credit payments will be divided between 2021 and 2022. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying.

The maximum child tax credit amount will decrease in 2022 In 2021 the. Read customer reviews best sellers. Child tax credit payments will revert to 2000 this year for eligible taxpayers.

Furthermore the child tax credits payments in 2021 were worth up to 3600. 1 day agoEnhanced child tax credit. Joe Manchin in particular has reportedly objected to the.

1 day agoPeople participate in a protest outside of the University of California Los Angeles. Ad Parents E-File to Get the Credits Deductions You Deserve. The Child Tax Credit provides money to support American families.

Generally this is 1800 per younger child and 1500 per older child the. However despite calls for the expanded Child Tax Credit payments to be. In Rhode Island families will get 250 per child and a maximum of 750 total for.

Here is some important. Browse discover thousands of unique brands. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Leading the charge is President Joe Biden himself who included a proposal to.

How The Expanded Child Tax Credit Payments Work Fox43 Com

What Is The Child Tax Credit And How Much Of It Is Refundable

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

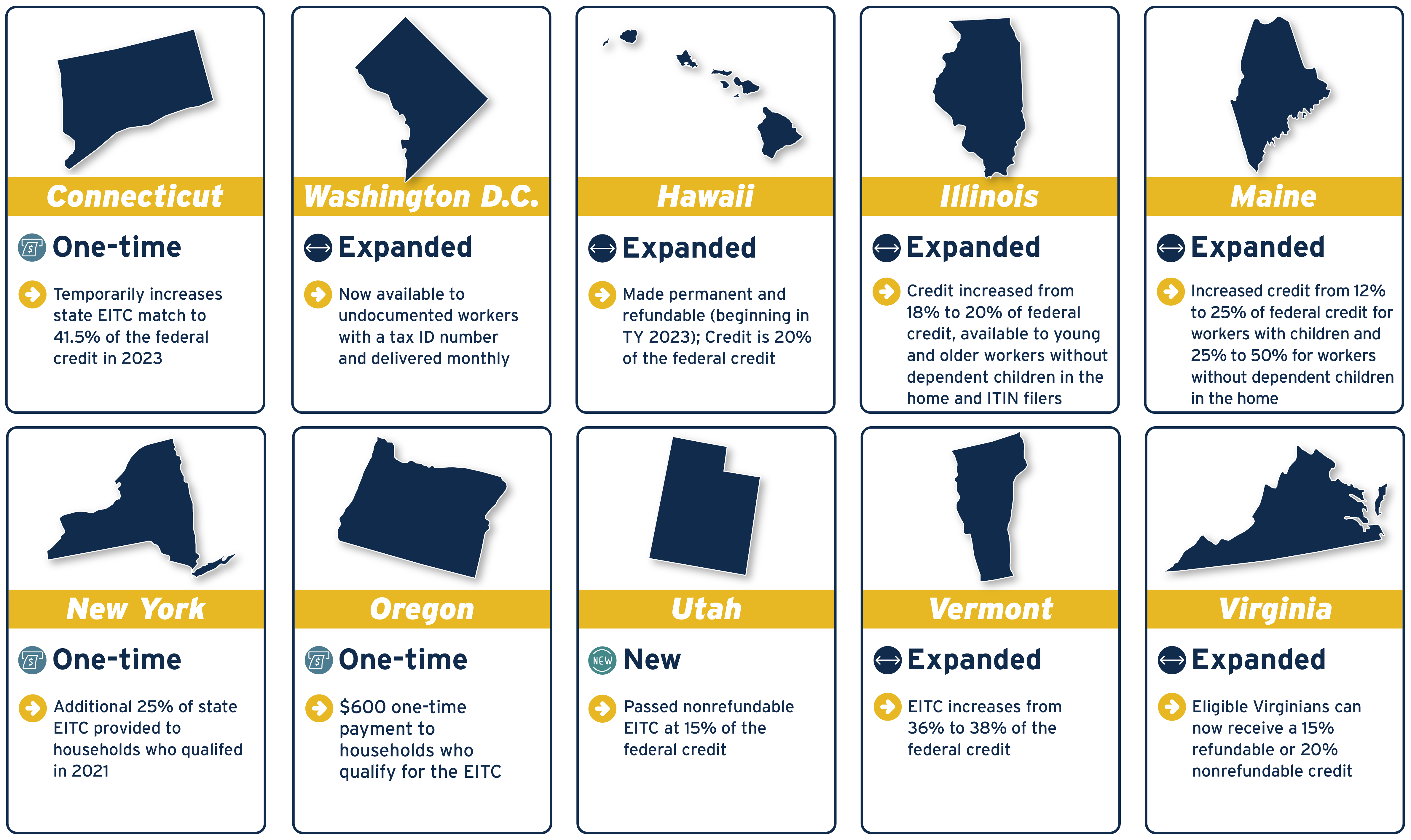

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

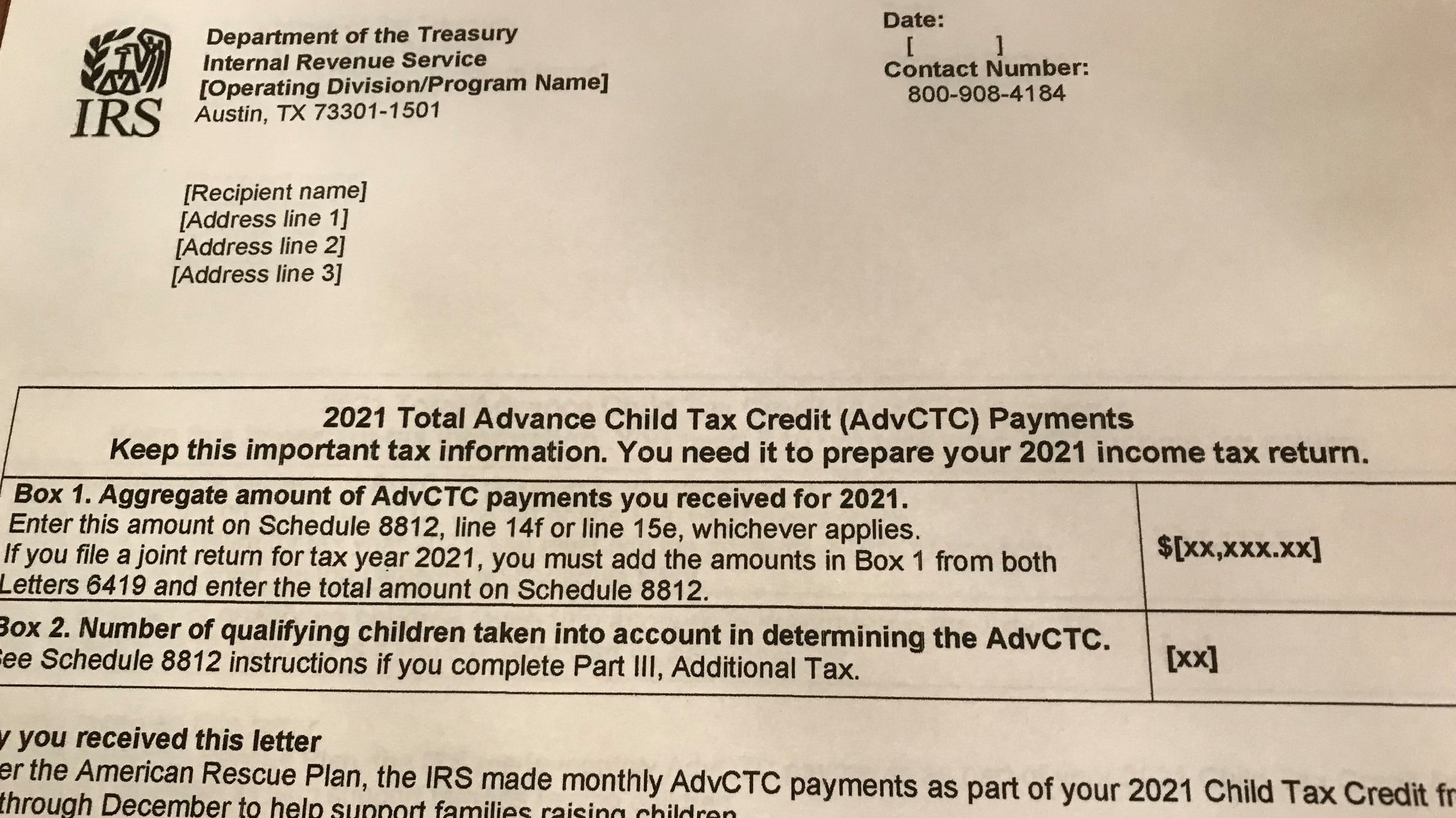

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Lgbtqi Families Need Congress To Make The Expanded Child Tax Credit Permanent Family Equality

Parents Can Still Claim Their Expanded Child Tax Credit By Nov 15 2022 Here S How

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

What Is The Child Tax Credit Tax Policy Center

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Here S What To Know For 2022 Bankrate

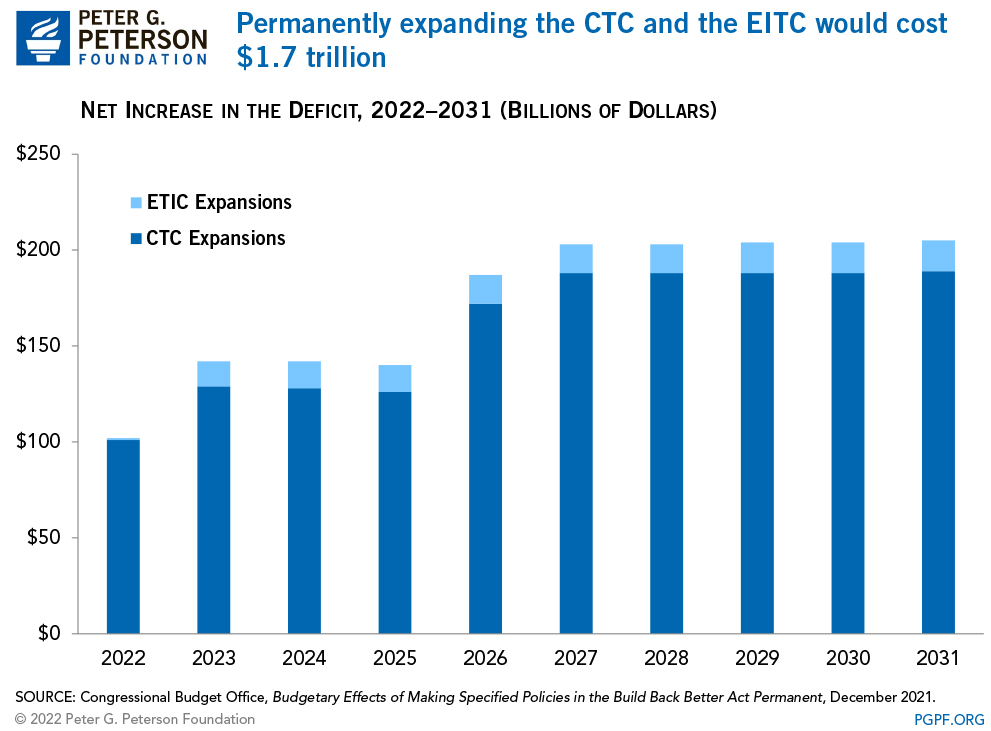

What Are The Costs Of Permanently Expanding The Ctc And The Eitc